Find Your Dream Career

Looking for your next role? LiveHire lets you instantly connect with the companies that you want to work for.

Build Your Unique Profile

Showcase your skills, experience, and unique abilities in your Talent Profile. Creating a LiveHire profile allows you to connect instantly and privately with multiple companies using a single profile. Every update on your profile is sent in real time to the companies you've chosen to connect with.

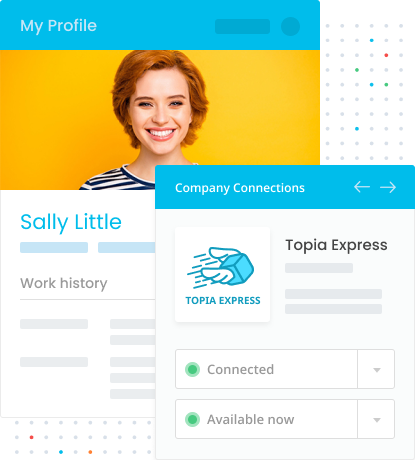

Join Your Favourite Brand’s Talent Community

LiveHire’s Talent Communities allow you to express interest in a company, not just a specific role. This means that when a role does become available, you’ll already be on the employer’s radar. You’ll also be able to identify potential employers across all industries, broadening your job search and increasing the likelihood of finding the right role for you.

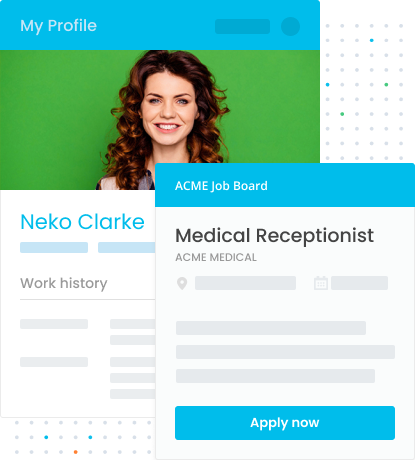

Apply for Roles With One Click and One Profile

Applying for roles is a breeze with LiveHire. Use your profile to apply for jobs and skip the tedious task of filling out your basic information, to instead focus on high-value documentation such as cover letters or extra application material. Your profile details can be updated at any time, meaning you're always ready to go as soon as a role becomes available.

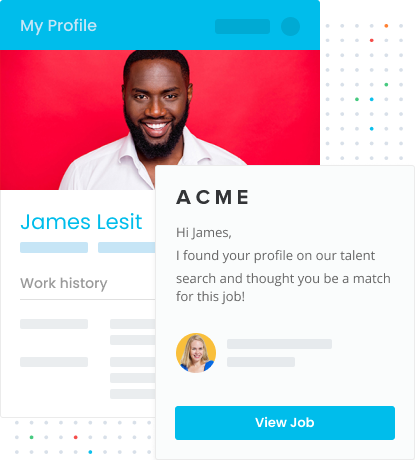

Connect With Employers

LiveHire enables 2-way text messaging, making it easier than ever to connect with your future employer. 2-way text messaging allows you to respond quickly and easily to potential employers without the need for any cumbersome technology. Whether its scheduling interviews, providing reference details or accepting your offer, the LiveHire platform enables you to do all this with mobility and accessibility.

Connect Now

Create your unified profile to connect privately with companies you aspire to work for.